Understand The Home Buyer Rebate

According to the U.S. Department of Justice, forty states, including California, allow real estate agents to give a home buyer rebate to their clients. The DOJ even condones negotiating rebates to increase competition among real estate agents. But what is a rebate? Is it the same thing as a first-time home buyer credit? The biggest benefit from a home buyer rebate is that it makes buying a home less expensive! You get to do whatever you want with the money.

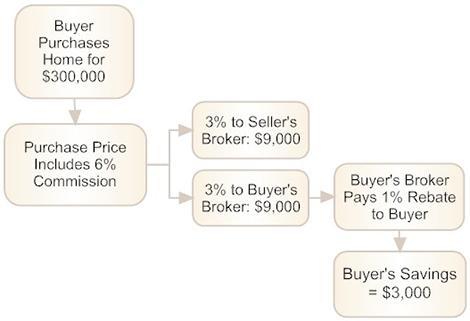

Traditional Real Estate Commission

Real estate agent commission is typically split 50/50 between the agents who represent the buyer and seller. So, out of a gross 6% commission, your agent would only typically get 3% gross. The Internal Revenue Service has ruled that rebate isn't taxable but is an adjustment to the buyer's basis in the house, which effectively lowers the home's purchase price.

Use Crush Mortgage on the purchase of your home in conjunction with Crush Mortgages Approved Realtors and receive 25% of the real estate commission.

How Does The Home Buyer Rebate Work?

The Crush Mortgage approved agents offer home buyer rebates of 25% of the buyer's agent commission. You don't need to use Crush Mortgage and the approved realtor list in conjunction. You can use the agent separately from Crush Mortgage or even Crush mortgage separate from the approved Realtor list. The 25% commission rebate is offered when you use Crush for the mortgage and Crush Mortgage's approved realtors and close on our home.

The Department of Justice's article has a great diagram (below) showing how the savings can break down based on a hypothetical $300,000 priced home purchase with a 1% buyer rebate.